Mobile Deposit FAQs

Section Menu

What is Mobile Deposit?

Mobile Deposit offers you a secure, convenient way of depositing paper checks into your checking account using an iPhone™ and Android™ smartphone.

How should I endorse the check?

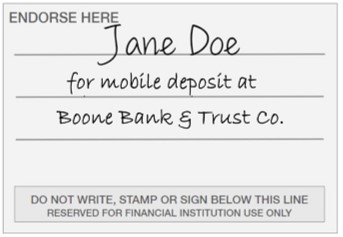

All checks must have a restrictive endorsement. Any check without this restrictive endorsement will be rejected until it is properly endorsed. This means your check must have your signature and the phrase "for mobile deposit at Boone Bank & Trust Co." Example:

How do I deposit a check with Mobile Deposit?

If you haven't done so already, download and install the Boone Bank & Trust Co. Mobile App (click here to install). Once logged in to the app you should:

- Endorse the check for deposit by signing the back of the check and writing "For mobile deposit at Boone Bank & Trust Co."

- Tap the "Check Deposit" tab at the bottom of your screen.

- If this is your first time using Mobile Deposit, accept the Mobile Deposit Services Agreement to proceed.

- Select "Get Started" button.

- In the "To" field, choose the deposit account (checking is the only account available at this time).

- Enter the amount of the check.

- Select "Front of Check" button and snap photos of the front of the check by tapping the screen.

- Make sure the photo is readable, including the routing and account numbers at the bottom. Tap "Keep picture" if the photo looks good.

- If you have not endorsed the check, you can do so now. Tap the "Back of Check" button and snap a photo of the bank of the check.

- Make sure the photo is readable, including the endorsement. Tap "Keep picture" if the photo looks good.

- Tap "Look at picture" to review your images to confirm they are readable.

- Tap the blue "Deposit" button to complete the deposit.

- The "Success!" screen will confirm if the deposit was received -- check your email to confirm if the deposit was accepted or rejected.

Who is eligible to use Mobile Deposit?

Mobile Deposit is available to Online Banking users who have a checking account and are in good standing with Boone Bank & Trust Co. (Boone Bank & Trust Co. has the right to not approve, suspend or terminate the use of Mobile Deposit at any time and without prior notice.)

What type of mobile device do I need to use Mobile Deposit?

Mobile Deposit is supported on mobile devices that meet the following criteria:

- Android or iPhone device

- A 2MP or higher camera

- Apple iOS 4.0 or later - both smartphones and tablets

- Android 1.5 or later - both smartphones and tablets

What version of the Boone Bank & Trust Co. Mobile App do I need to use Mobile Deposit?

Mobile Deposit is a feature included in the most recent version of Boone Bank & Trust Co. Mobile App.

When will the funds be available?

Check deposits made using Mobile Deposit are subject to verification and will generally be available for withdrawal within one (1) business day.

You will receive the "Success!" message once a deposit is successfully submitted, but please note this does not mean your deposit has been accepted. Next, the check will be reviewed for readability, conformity to the Services Agreement, and to verify payee name and amount. Once a deposit is accepted or rejected, you will receive an email notification of this decision.

Deposits received on weekends, federal holidays and Monday through Friday after 4:00 p.m. central time are processed on the following business day.

All new accounts are subject to immediate deposit holds within the first 30 days of opening.

Are there limits for deposits made using Mobile Deposit?

You are not limited to the number of deposits you can make using Mobile Deposit. However, the default deposit limit is $2,500 per day. You can request a limit change by calling 515-432-6200. Limit changes are subject to review and approval.

What do I do with the paper check after the deposit is submitted?

Once your check image has been credited to your account, you must retain the check for 60 days. You may not present the original check or any image or substitute check created from the original check for payment at any other financial institution. During this 60 day period, you must store the original paper check securely and you must make the original paper check available to us for review at any time and as necessary for us to facilitate the clearing and collection process, to address third party claims, or for our own auditing purposes. The check should be securely destroyed and/or voided after the 60-day time period.

Who can I contact with additional questions?

In the “More” tab of the app, there is a “non-secure message” option which will generate an email to the bank, as well as an option to call us.